Table of Contents

There is no denying that passive income is one of the most popular and sought-after topics of personal finance, and for a good reason. From building wealth to escaping a lifestyle in which one’s lifestyle depends on paychecks; passive income can be the best way to earn stable money.

In other words, passive income creates stability, freedom, and security in your financial life. And the best thing about passive income is that it doesn’t depend on your time and effort, which means you can build wealth without doing much (except in the beginning). If that is not convincing enough for you, check out the following list.

1. Improved Financial Stability

On the road to creating wealth, one of the most crucial steps is being financially stable. If you can look at your current financial situation and say out loud that you can withstand a strong financial storm, then you are on the right path.

Let’s make it a bit easy for you: if you can count your money coming in without putting too much time and effort, then financial stability is just around the corner. When you don’t have to work for every penny you earn, it gives you mental peace and allows you to make wise financial decisions that, in turn, improve your financial stability.

2. Personal Growth

If you are sick and tired of your same old working routine and want a massive change, earning a passive income is your best bet. As passive income increases your finances, there is a high chance that you can reach your financial goals compared to when you were relying on your 9 to 5 job.

When you are financially free, you will have much more time to do things you have always wanted, such as spending more time with your family, working on a new skill, going on a road trip, etc.

3. Leverage Others’ Expertise and Experience of Others

One of the best things about passive income is that you don’t need to have a set of particular skills to earn money. You only have to find the right passive income stream, invest in it, leverage the expertise and experience of others, and reap its benefits. You always have an option to invest without interacting with anyone else, such as online brokering, crypto trading, or stocks. But how about taking benefits of someone else’s intelligence?

For example, some real estate investors spend their lifetime learning the ins and outs of real estate. With passive real estate investing, you can leverage their experience and deep education in the field.

4. Say No to Living a Paycheck-to-Paycheck Lifestyle

There is nothing more stressful for an employee living a paycheck-to-paycheck lifestyle. One has to rely on their monthly salary to fulfill their lifelong dreams. If that’s your situation, then adding passive income to your life is one of the most beneficial steps you can take.

In simple words, you are trading time with money, which can get overwhelming at times. And on separating yourself from reliance on your next paycheck, you will feel lighter and relaxed than ever.

If you want to escape from this tiring lifestyle, follow the recommendation that you work towards developing some good passive income streams.

5. Multiple Income Streams

A good businessman never depends on a single income stream, and with passive income, you can create multiple income streams only with good research. But that isn’t easy. It may take a lot of effort and a reasonable amount of time to research beneficial income streams. Although it requires research, hard work, and trial and error to make multiple income streams, it doesn’t mean you cannot.

That being said, remember not to invest in something that isn’t fruitful, and for that, you need to research deeply.

6. It Becomes Easier to Achieve Your Goals

This benefit somehow relates to the point mentioned above. If you have done solid research and found a few beneficial passive income streams to invest in, it will become much easier to achieve your goals (including financial ones).

The road to generating passive income streams might be difficult but put the destination in your mind and reap all its benefits.

7. Location Independence

Does your job require you to move from one city or country to another frequently? If so, passive income is for you. It allows you to live and work from anywhere you want without being dependent on your physical location.

Since you don’t have to work regularly to earn passive income, you also don’t need to be in a specific area to make money through your passive income source. If you are earning enough passive income to fund your lifestyle, you can travel the entire planet if you want, and that too without working a day in your life.

8. Reduced Stress

Did you know stress is the worst enemy of your health? You don’t want to make it a significant part of your life. Here, passive income has a unique way of reducing your financial stress. Since passive income increases your financial freedom, stability, margin, and much more, it is natural that it can help reduce your financial stress.

So, if your current financial situation is letting you down and causing stress, you need to focus a little on finding and investing in a reliable passive income stream.

9. Early Retirement

It is a dream of everyone to retire early with bags full of money to fund the rest of their life without working another day. If you create passive income streams and start earning stable money from them, you may be able to take an early retirement. You could accomplish this by investing in the stock market or building a business that runs without you or combining a few other ways. Passive income is important if you want to retire early.

10. It’s Exciting!

Last but not least, earning passive income can be very exciting! Just imagine waking up in the morning, checking your bank account, and seeing that you made a couple of hundred or even a thousand dollars while you were asleep. Isn’t it exciting? That is what an excellent passive income source can do (we will discuss so many later in this eBook).

The more enthusiastic you are about your financial situation, the more room there would be for improvements.

Potential Downsides of Passive Income

Did you read all the benefits of passive income? It is time for you to learn about some of its potential downsides as well.

1. Passive Income Requires Diversity

To make sufficient passive income to quit your full-time job and fund your whole life, you would most likely need to have multiple passive income streams than putting all your eggs in one basket. Although you might not need to do a 9-5 job, it is still essential to spend time managing multiple income streams.

2. Getting Started May Require Investment

Depending on your passive income plan and stream, chances are you will require an initial financial investment to get started. For example, you might need money to buy a new property, create a new product, start a new business, or invest in dividend-yielding stocks.

3. Earning Passive Income is Not Much of a Passive Activity (In Some Cases)

Whether you earn passive income through email marketing, affiliate marketing, rental property, or any other way, you might still need to put in some time and effort. Also, it takes time to get these passive income sources up and running, and they don’t always work out as you planned initially.

Top Strategies of Passive Income

Many people dream of a life after passive income as laying on the beach all day without any worries. However, it is not true (in most cases). Although you get to enjoy much more and have several opportunities to go on vacations when earning passive income, you might still have to put in a lot of effort.

Following are some of the best passive income strategies that you must be familiar with to bring yourself closer to financial freedom:

1. Opting for a Subscription-based Business

As the name suggests, this business model is based on monthly recurring payments from the customers who have signed up for a bundle of products or services. A magazine subscription is one of the traditional subscription-based models that have been there before everything became digital.

According to McKinsey Report, the market for subscription-based business has been increased about 100% in the past five years. The report stated that these business models appeal to the younger, affluent urbanites, especially the Northeastern women (USA).

One of the best things about this business model is the stable, regular income you earn without doing anything but keeping your customers happy. The perfect example is Amazon that generated $1.4 million from just its subscription memberships in one quarter (source).

2. Affiliate Marketing

You can earn a small commission with affiliate marketing by promoting a product on your blog, social media handles, or YouTube channel. If you know about a product that you believe is of high quality, put an affiliate link in your blog or video description to it. For every sale made from that link, you’ll earn a commission. The best thing about affiliate marketing is you are genuinely earning while sleeping.

There are a few ways to start affiliate marketing that we will discuss later in the eBook.

3. Focusing on Income-generating Assets

To begin with the process of passive income, you will need to accumulate high-value assets whose specific purpose would be to generate passive income for you. You will have to be continually looking for and adding passive income-producing assets to your portfolio.

Once you have successfully generated a few income streams, you can accumulate even more income-generating assets by reinvesting the money earned from the assets you already own into new ones. Adding additional money to your passive income stream from your job or business income can also prove fruitful and accelerate your progress towards early retirement.

Over time, with the combination of new cash and reinvesting in passive income-producing assets, you will soon find that your income keeps on going up. At some point, especially if you already have multiple streams, your passive income might enable you to cover your living costs completely or partially.

4. Creating a Digital Product

Any digital product you can market and sell to your audience will give you a lot of benefits in terms of passive income in the future. For example, you can write an eBook, instruction guides, create an online course, or whatever you think can sell. You don’t necessarily have to offer these digital products at a high price and still generate handsome passive income.

For instance, if you are selling your eBook for $7 to thousands of people, think of the income you will be generating. This amount might not sound massive but look at the bigger picture here. Small amounts can add up really quick when your product is being sold, like hotcakes.

We will discuss every little detail on generating a passive income from an eBook later in this guide.

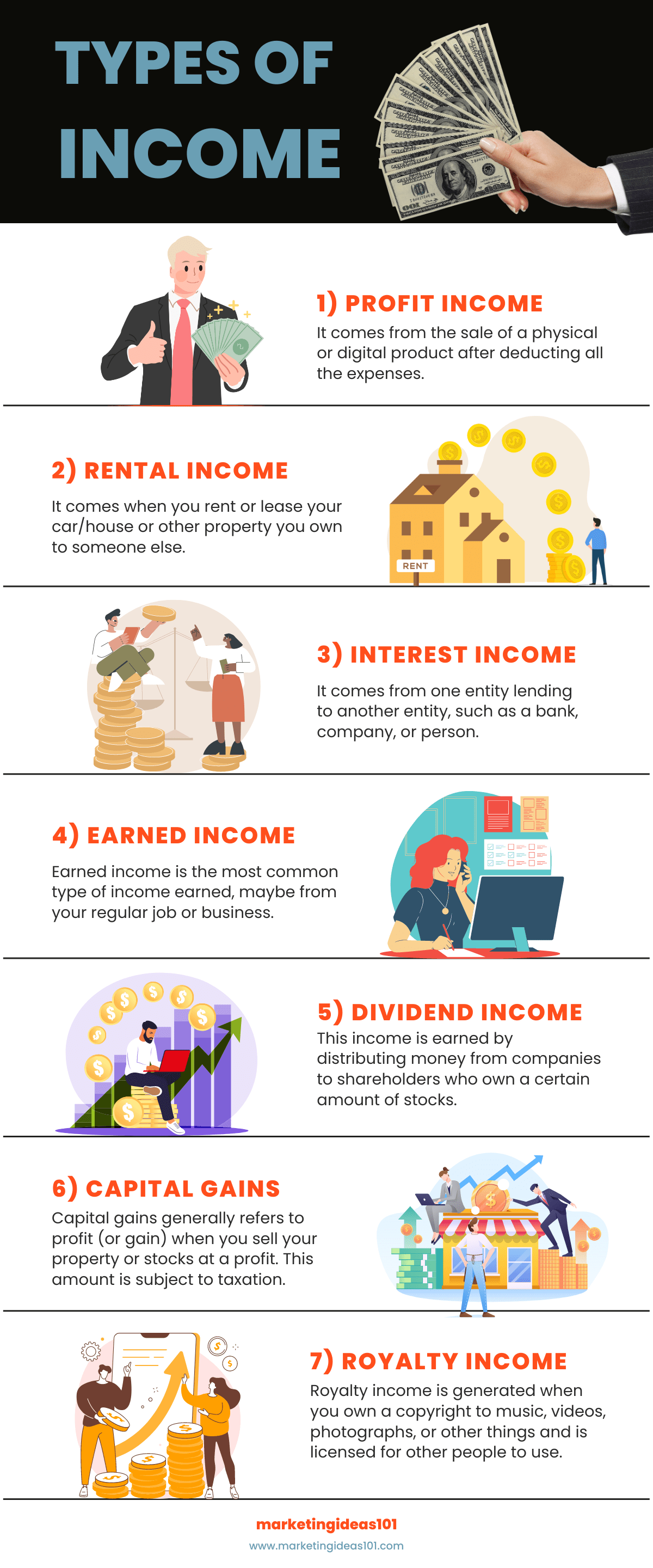

Types of Income

In addition to passive income, there are several other types of income you can earn:

1. Profit Income

It comes from the sale of a physical or digital product after deducting all the expenses.

2. Rental Income

It comes when you rent or lease your car/house or other property you own to someone else.

3. Interest Income

It comes from one entity lending to another entity, such as a bank, company, or person. Interest income can also be referred to as income generated every year from your savings account and Certificates of Deposit.

4. Earned Income

Earned income is the most common type of income earned, maybe from your regular job or business. With earned income, you are trading your precious time for money.

5. Dividend Income

This income is earned by distributing money from companies to shareholders who own a certain amount of stocks.

6. Capital Gains

Capital gains generally refers to profit (or gain) when you sell your property or stocks at a profit. This amount is subject to taxation. Moreover, there are both long- and short-term capital gain taxes, depending on how long you kept the asset before selling it out.

7. Royalty Income

Royalty income is generated when you own a copyright to music, videos, photographs, or other things and is licensed for other people to use. For example, if someone uses your music in their video or movie, they must give you a royalty; otherwise, they must pay the legal penalties for copyright infringement.

Types of Passive Income

Investing Your Money

1. Buying a Company

Although it can take an upfront payment, you can become a silent partner and earn a good passive income. A business such as a laundromat or a car wash has the potential to earn solid passive income each month.

2. Buying a Rental Property

Another popular source of passive income is buying a rental property and renting/leasing it to someone else.

3. Opening a High Yield Savings Account

By opening a high-profit savings account in the bank, you allow the entity to use your money for investment purposes against which you can earn a certain amount of interest every year. However, you should thoroughly research it before opening a savings account with a bank or an online platform.

4. Investing in Index Funds or Dividend-Paying Stocks

Although continuous passive income is not a guarantee in dividend-paying stocks, some investors like to see the ups and downs of the stock market. Dividend-paying stocks typically pay their shareholders annually or quarterly and often allow them to reinvest the dividends.

Investing Your Time

1. Starting a Blog

If you like to write and are passionate about a specific niche, you can blog on it and earn money through affiliate links and ads.

2. Creating an App

If you have a unique idea for a mobile app that you think will be useful to many people, you should develop it yourself (if you know how to) or hire a development team to create it. However, this requires the investment of both your time and money.

3. Creating an Online Course

If you are knowledgeable about a specific skill, you can create an online course, market it, and sell it to people looking to learn that skill. For example, if you are a Photoshop expert, you can create a video course on how to use it and cover different elements. People interested in learning Photoshop will surely buy your course if they find it interesting and valuable.

4. Licensing Your Photos

Professional photographers and photography enthusiasts can cash their pictures by selling them online or licensing them. For every person buying your photo, you will earn some money. A great way to sell your photos is on stock sites, such as Shutterstock.

Although there are several benefits of generating passive income, we cannot ignore the negatives that come with it. If you want to change your life for good and be financially free, you will need to take risks in life. After learning the pros and cons of passive income and its types, we are ready to take one step ahead and read more about how to create fruitful passive income sources.